How U.S. Treasury Yields Influence Asia's Commercial Property Market: A Singapore Focus

Desmond Ng • 22nd May 2025

Executive Summary

Our analysis reveals that while rising U.S. yields have compressed CRE spreads and challenged valuations across Asia Pacific, Singapore's commercial property market has demonstrated remarkable resilience. This resilience stems from Singapore's strong macroeconomic fundamentals, proactive monetary policy, and strategic positioning as a financial safe haven amid global uncertainties.

The implementation of U.S. tariffs in early 2025 has introduced additional complexity to the investment landscape, with varying impacts across Asian economies. However, our research indicates that core markets like Japan, Korea, and Singapore are likely to attract incremental investment capital as investors prioritize stability and quality amid heightened volatility.

For institutional investors and family offices, this environment presents both challenges and opportunities. The flight to quality within Asian real estate markets is accelerating, with prime assets in stable jurisdictions commanding premium valuations despite broader market pressures. Strategic allocation to Singapore's commercial real estate sector, particularly through S-REITs with strong balance sheets and quality portfolios, offers an attractive combination of yield, stability, and potential capital appreciation as interest rates normalize.

Key Insights

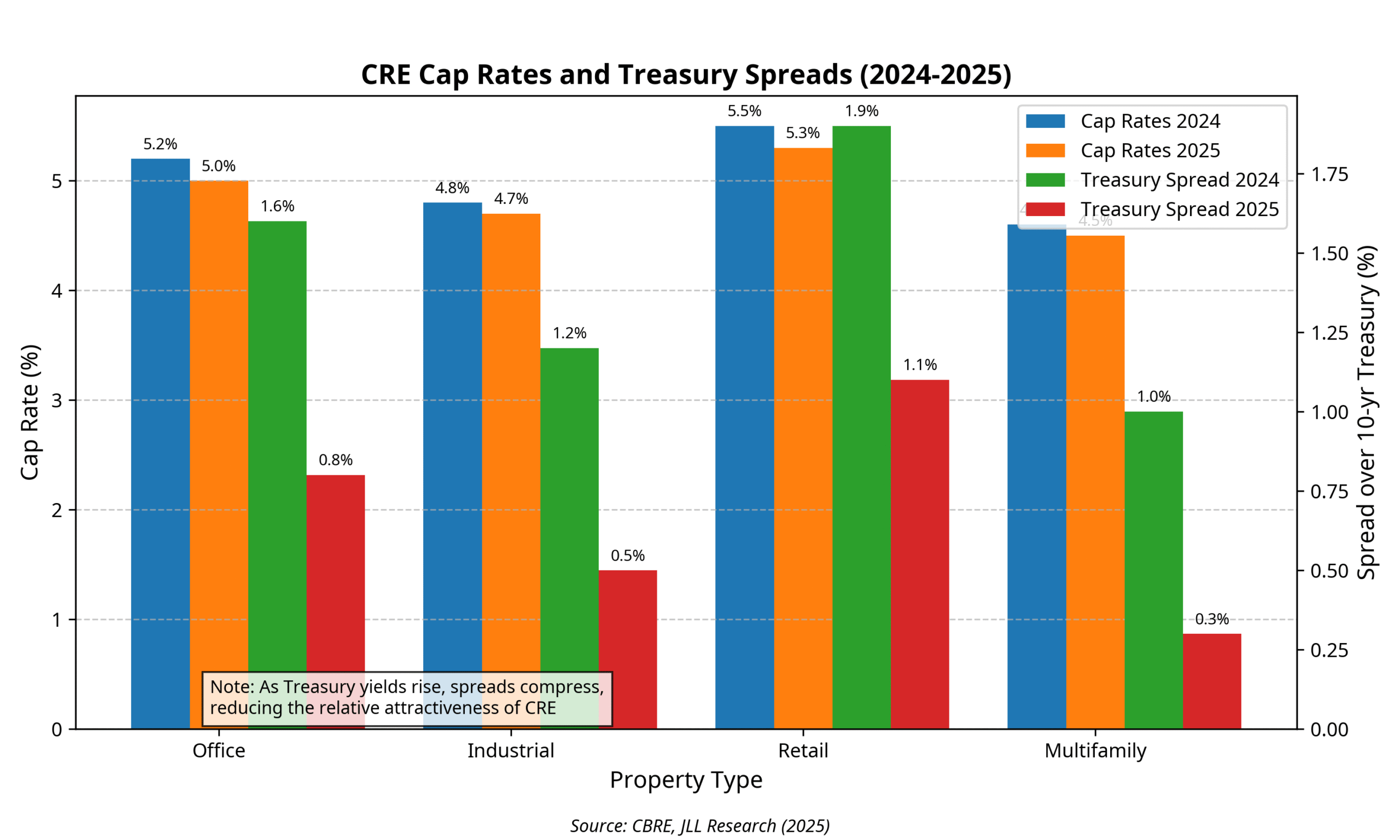

2. Spread Compression: Rising Treasury yields have compressed risk premiums for commercial real estate, with average spreads narrowing from 120-190 basis points in 2024 to 30-110 basis points in 2025 across major property types

1. U.S. Treasury Yields and Global Capital Flows

Recent Yield Movements and Drivers

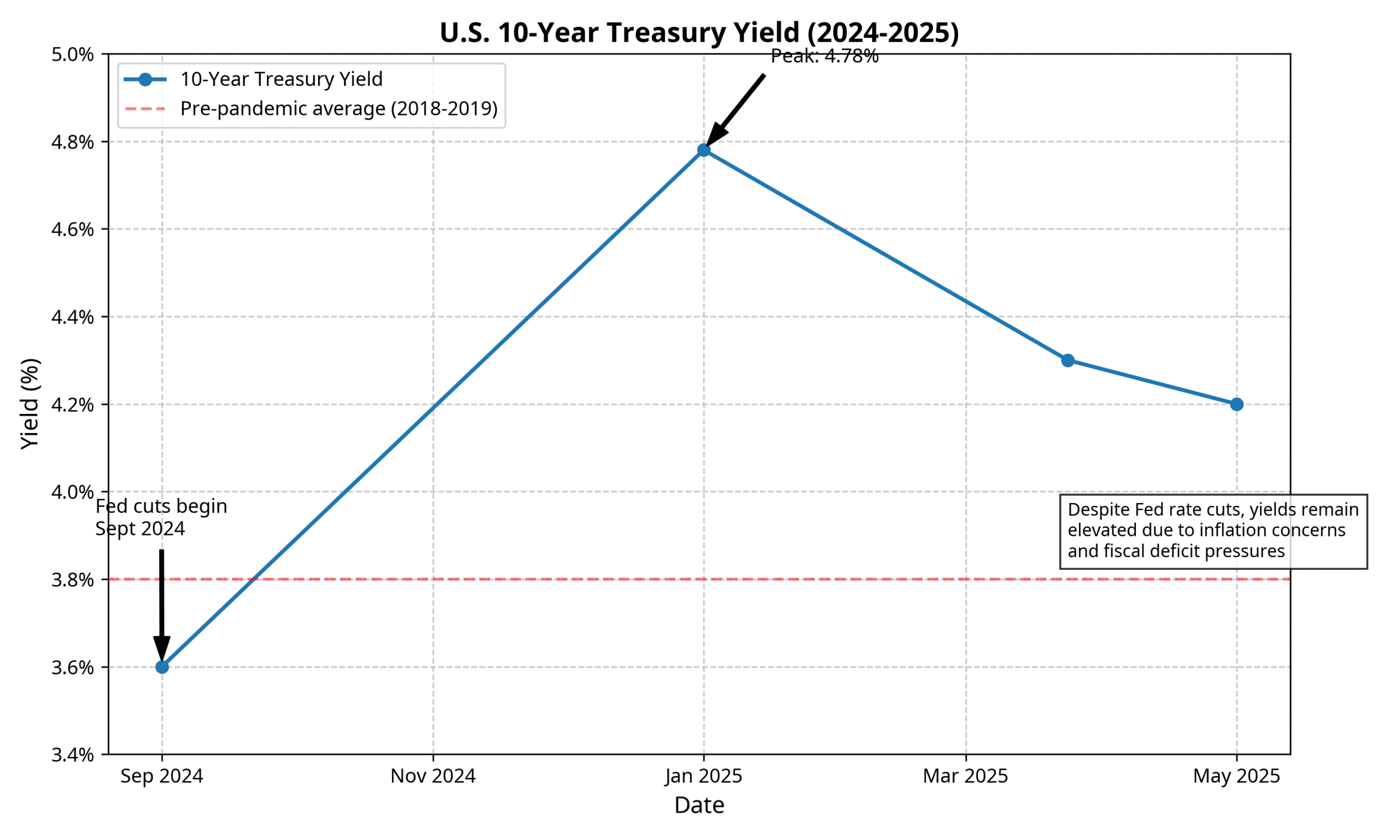

The trajectory of U.S. Treasury yields in 2024-2025 has defied conventional expectations. Despite the Federal Reserve initiating an easing cycle in September 2024 with cumulative cuts of 150 basis points, the 10-year Treasury yield increased by more than 100 basis points to a peak of 4.78% in early January 2025. This counterintuitive movement reflects persistent inflation concerns, expanding fiscal deficits, and heightened geopolitical tensions.

As of May 2025, the 10-year yield has moderated to approximately 4.2%, still significantly above levels that would typically be expected given the Fed's policy stance. This disconnect between short-term policy rates and long-term yields has created a complex environment for global investors, particularly those allocating capital to long-duration assets like commercial real estate.

The elevated Treasury yields have triggered significant shifts in global capital flows. Institutional investors have increased allocations to U.S. fixed income, attracted by the combination of relatively high yields and the perceived safety of U.S. government debt. According to JLL's 2025 Global Capital Outlook, fixed-income allocations among sovereign wealth funds and private capital investors rose significantly in 2023-2024, while real estate, private equity, and hedge fund allocations declined.

Relative Attractiveness: U.S. Fixed Income vs. Asia-Pacific Real Estate

The persistent elevation in Treasury yields has fundamentally altered the risk-reward calculus for global investors. With 10-year Treasuries yielding approximately 4.2% with minimal credit risk, the relative appeal of alternative investments, including Asia-Pacific commercial real estate, has diminished.

This shift is particularly evident in cap rate spreads over Treasury yields. Historically, investors have demanded a premium of 200-300 basis points for core commercial real estate investments over risk-free rates. However, this spread has compressed significantly, with current premiums ranging from just 30-110 basis points across major property types in prime Asia-Pacific markets.

The compression in risk premiums has been most pronounced in markets and sectors where yields were already relatively low, such as Tokyo multifamily, Singapore office, and Australian industrial assets. These segments have experienced the greatest pressure on valuations as investors reassess required returns in light of higher risk-free alternatives.

Nevertheless, Asia-Pacific real estate continues to offer compelling attributes that U.S. fixed income cannot match:

2. CRE Valuations and Yield Correlation

The Inverse Relationship: Rising Rates and CRE Values

The relationship between interest rates and commercial real estate values is fundamentally inverse. As interest rates rise, the present value of future cash flows decreases, putting downward pressure on asset prices. Additionally, higher borrowing costs reduce leveraged returns, further dampening investor appetite.

This relationship has been clearly demonstrated in the current cycle. According to CBRE, commercial property values across Asia-Pacific have experienced approximately 20% repricing over the past three years, with substantially greater declines in certain sectors like office. This repricing reflects both the direct impact of higher discount rates and the indirect effects of tighter lending conditions and reduced transaction volumes.

The magnitude of valuation impacts has varied significantly by property type and market. Assets with longer lease terms, stable income streams, and strong tenant covenants have generally experienced less severe repricing. Conversely, properties with near-term lease expirations, weaker tenant profiles, or significant capital expenditure requirements have seen more dramatic valuation adjustments.

Cap Rate Trends and Investor Returns

Cap rates across Asia-Pacific commercial real estate markets have expanded by 50-100 basis points since 2022, though this expansion has been uneven across markets and sectors. The most significant cap rate adjustments have occurred in secondary markets and lower-quality assets, reflecting investors' flight to quality in an uncertain environment.

Looking forward, CBRE expects investment activity to pick up in 2025 with some cap rate compression, particularly in the second half of the year. However, the extent of compression will be limited because rates will not return to pre-pandemic levels. Nearly 70% of respondents to CBRE's 2025 U.S. Investor Intentions Survey indicated that elevated and volatile long-term bond yields were the top challenge for investment in 2025.

Despite these challenges, the outlook for total returns remains relatively positive. CBRE Econometric Advisors is forecasting an average 9.3% annual return for commercial real estate over the next five years (2025 to 2029). This forecast assumes modest income growth, limited further cap rate expansion, and some recovery in transaction volumes.

The composition of returns is expected to shift, with income yield comprising a larger portion of total returns compared to the capital appreciation-driven returns of the previous cycle. This shift favors core-plus and value-add strategies, which are expected to dominate investment activity in 2025.

3. Singapore as a Case Study

S-REITs Performance and Yield Correlation

Singapore REITs (S-REITs) offer a compelling case study of how U.S. Treasury yield movements influence Asian commercial property markets. As listed vehicles with daily mark-to-market pricing, S-REITs provide real-time insights into how investors are recalibrating risk premiums in response to shifting Treasury yields.

The performance of S-REITs in 2024-2025 has been characterized by heightened volatility and sector divergence. According to REITsavvy's 2025 Q1 Review, the sector kicked off 2025 "navigating a market still adjusting to the aftershocks of past volatility." Despite a more supportive interest rate environment and early signs of economic stabilization, the sector's recovery remained uneven through the first quarter.

Recent developments have been more encouraging. RHB analysts maintained their "overweight" call on S-REITs amid "softer interest cost pressures" – particularly for Singapore-centric REITs. Most S-REITs under RHB's coverage report lower overall interest costs, as "sharp falls" in domestic rates have benefited interest costs. The three-month key benchmark Singapore overnight rate average has declined 70 basis points year to date (as of May 2025).

This improvement in financing costs has coincided with a widening of yield spreads for S-REITs relative to alternative options like Treasury bills and Singapore savings bonds. This widening spread has created room for potential fund inflows to the sector, particularly if global trade tensions ease.

Foreign Capital Inflows and Property Prices

Singapore's commercial real estate market has demonstrated remarkable resilience in attracting foreign capital despite global uncertainties. According to JLL's Capital Tracker (April 2025), Singapore's commercial real estate investment volume rose 16% year-on-year to USD 2.2 billion in Q1 2025, with investors focusing on higher-yielding assets.

This performance is particularly impressive in the context of broader regional trends. Asia Pacific real estate markets demonstrated resilience in Q1 2025, with investment volumes reaching USD 36.3 billion, up 20% year-on-year. This marked the sixth consecutive quarter of annualized growth, showcasing the region's adaptability amid global economic shifts.

Several factors have contributed to Singapore's continued appeal to foreign investors:

Property prices have reflected this sustained demand, with prime office and industrial assets showing particular strength. While there has been some moderation in price growth, the correction has been far less severe than in many other global markets facing similar interest rate pressures.

Singapore's Macroeconomic Strengths

Singapore's commercial property market resilience is underpinned by several macroeconomic strengths that differentiate it from other Asian markets:

These strengths have positioned Singapore as a relative safe haven within the Asia-Pacific commercial property landscape, attracting both regional and global capital seeking stability amid uncertainty.

4. Monetary Policy & Regional Impact

MAS Policy Response to U.S. Tightening

The Monetary Authority of Singapore (MAS) has demonstrated a nuanced and flexible approach to monetary policy in response to evolving global conditions, including U.S. Treasury yield movements and trade tensions.

In January 2025, MAS reduced slightly the slope of the S$NEER policy band, with no change to the width of the policy band or the level at which it was centered. This measured adjustment was described as "consistent with a modest and gradual appreciation path of the S$NEER policy band that will ensure medium-term price stability."

The decision was based on two key factors:

In April 2025, MAS further eased its monetary policy settings in response to threats to growth from U.S. tariffs. The central bank adjusted its core and headline inflation forecasts for 2025 downward to 0.5% to 1.5% from a previous 1% to 2%.

This policy flexibility has been a key factor in supporting Singapore's commercial property market, helping to offset some of the pressure from elevated U.S. Treasury yields.

Regional Central Bank Responses

Asian central banks have pursued divergent policy paths in response to the complex mix of global pressures, including U.S. Treasury yield movements, inflation dynamics, and trade tensions.

The Bank of Japan has remained an outlier by continuing to normalize monetary policy after ending its negative interest rate experiment in March 2024. The BOJ raised its benchmark rate to 0.5% from 0.25% in January 2025 and is expected to reach a terminal rate of 1.0% by 2026. This tightening cycle is supported by a favorable combination of inflation and wage increases in Japan.

In contrast, other major Asian central banks have either paused tightening or begun easing:

1. Reserve Bank of India: Initially delayed rate cuts to April-June from FebruaryApril, partly due to external sector volatility, with the Indian rupee declining nearly 3% against the US dollar

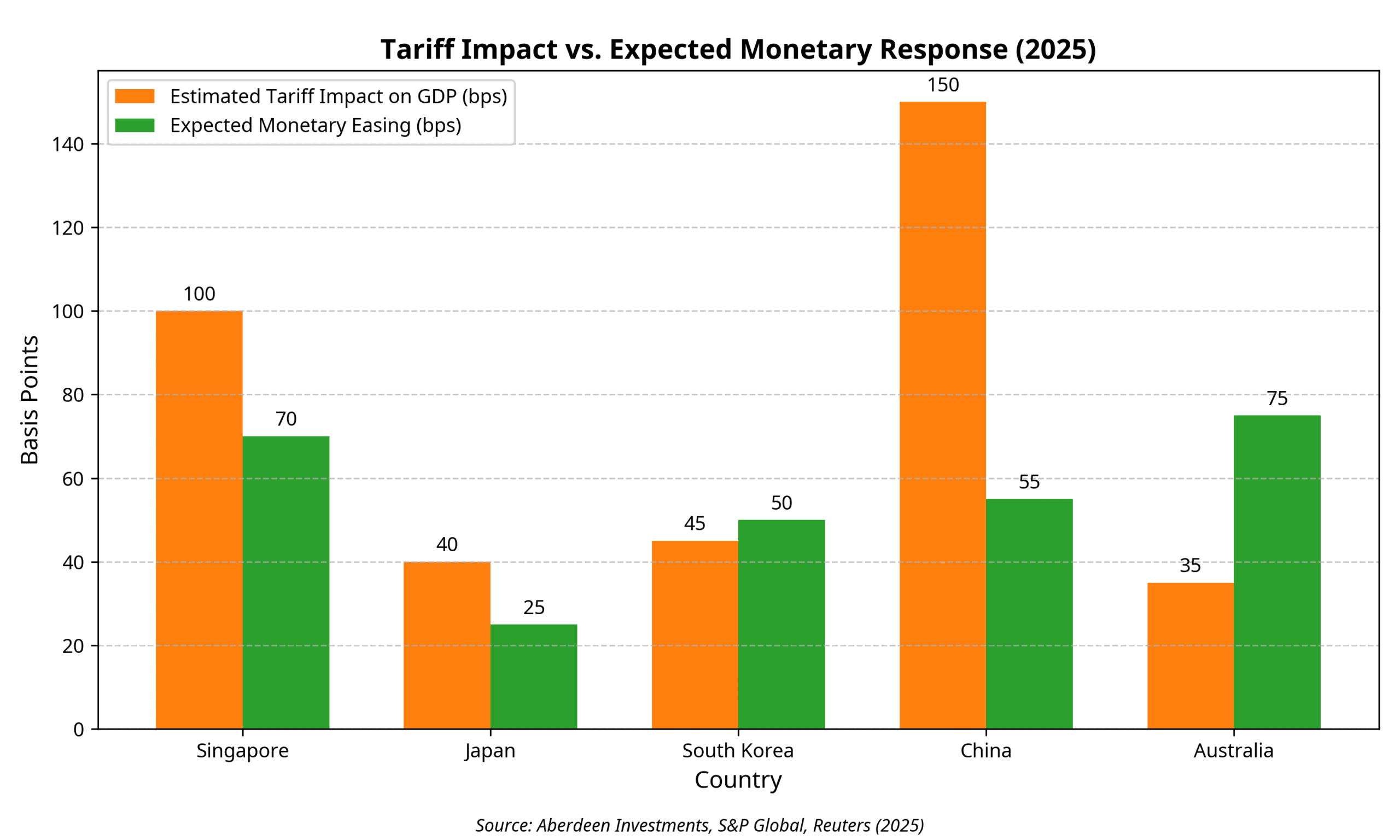

2. Reserve Bank of Australia: Pivoted to a more dovish stance with expected rate cuts beginning in May 2025, supported by slower-than-expected economic growth and inflation rates moving within the central bank's target range

3. People's Bank of China: Maintained easy monetary conditions with expected "50- to 60-basis-points cuts in China policy rates in 2025" to support growth amid a sluggish housing sector

These divergent policy paths reflect the varying impacts of global pressures on different Asian economies, as well as differences in domestic economic conditions and policy priorities.

Inflation and Policy Flexibility Comparison: Asia vs. U.S.

A key advantage for many Asian economies, including Singapore, is their relatively favorable inflation dynamics compared to the United States. This advantage provides greater monetary policy flexibility and helps to insulate commercial property markets from some of the pressures associated with elevated Treasury yields.

Singapore's inflation outlook is particularly benign, with MAS Core Inflation forecast at just 0.5% to 1.5% for 2025 and CPI-All Items inflation forecast at 1.5–2.5%. This compares favorably to U.S. inflation, which remains more persistent despite significant monetary tightening.

The lower inflation environment in Singapore and several other Asian economies reflects multiple factors:

1. Exchange Rate Management: Singapore's exchange rate-based monetary policy has been effective in managing imported inflation.

2. Supply Chain Normalization: The resolution of pandemic-era supply chain disruptions has helped to moderate price pressures.

3. Energy Price Stabilization: The moderation in global energy prices has had a disproportionately positive impact on many Asian economies that are net energy importers.

3. Fiscal Support: Targeted government subsidies for essential services have dampened consumer price inflation in Singapore and other markets

This favorable inflation backdrop has allowed Asian central banks, including MAS, to maintain more accommodative monetary policies than would otherwise be possible. According to the IMF, "Asian central banks have space to ease rates to soften US tariff hit," providing a potential cushion for commercial property markets in the region.

5. Tariffs, Trade War & Market Sentiment

Current U.S. Tariff Regime and Regional Impact

The U.S. tariff regime implemented in early 2025 represents a significant shock to the Asia-Pacific economic landscape, with varying implications for commercial real estate markets across the region.

Since taking office in January 2025, President Trump has announced numerous tariffs on imports to the U.S., with the average weighted U.S. tariff higher than at any point since the 1930s. Although reciprocal tariffs announced for most countries in early April are on pause, many markets across Asia Pacific currently face tariffs of at least 10%.

China faces the highest rate of tariffs, though a U.S.-China joint announcement on May 12 temporarily lowered the U.S. rate from 145% to 30% for 90 days pending continued negotiations. Several Southeast Asian markets are also subject to high tariffs, while certain sector-specific tariffs, including a 25% duty on auto exports to the U.S., remain in effect.

The economic impact of these tariffs varies significantly across the region:

1. China: Most observers expect the tariffs to shave 100-200 basis points off China's near-term growth.

2. Japan and Australia: Initial estimates suggest a negative impact of 30-50 basis points on near-term economic growth.

3. Singapore and Hong Kong: As more open economies, these markets face potential growth impacts of around 100 basis points.

These growth headwinds have significant implications for commercial real estate demand, particularly in the industrial and logistics sectors most directly tied to trade flows.

Impact on CRE Investment Sentiment

The tariff regime has introduced additional uncertainty to an already complex investment landscape, influencing commercial real estate sentiment across Asia-Pacific. In light of the tariffs and ongoing negotiations, market participants anticipate elevated uncertainty and heightened financial market volatility. This environment has accelerated several key trends in commercial real estate investment:

1. Flight to Quality: Investors are increasingly favoring lower-risk core markets like Japan and Korea amid prevailing uncertainties. Portfolio quality and sponsor strength have emerged as key differentiators, with REITs having robust tenant bases, long weighted average lease expiries (WALEs), and conservative balance sheets demonstrating greater resilience.

2. Sector Rotation: The living sector ranks highly in global investment preferences, with the Tokyo multifamily investment case remaining robust despite potential economic slowdown. Office occupier fundamentals in Tokyo and Seoul are also likely to withstand the near-term negative growth shock, with vacancy rates in both cities among the lowest globally.

3. Sector Rotation: Pricing Recalibration: While the negative growth shock is likely to dampen overall leasing demand, tenants' flight to quality/location continues, especially as negotiating power shifts towards tenants. This dynamic is creating a 'K-shaped' recovery pattern not just between markets but also between different locations and grades within the same sector

Despite these challenges, there are reasons for cautious optimism. According to the South China Morning Post, "Trump's tariffs will inevitably dampen sentiment towards Asian real estate, but domestic demand will act as a shock absorber." This domestic demand buffer is particularly relevant for markets like China, Japan, and India with large internal economies

Risk and Investor Behavior in Uncertain Climates

The combination of elevated Treasury yields and trade tensions has fundamentally altered risk perceptions and investor behavior in Asia-Pacific commercial real estate markets.

Institutional investors have become increasingly selective, focusing on:

- Defensive Positioning: Core assets in prime locations with strong tenant covenants are commanding premium valuations despite broader market pressures.

- Income Security: Properties with long-term leases to credit-worthy tenants are particularly sought after as investors prioritize stable cash flows over speculative capital appreciation.

- Operational Excellence: Assets and operators with proven track records of navigating market cycles are attracting disproportionate investor interest.

- ESG Compliance: Sustainability considerations are increasingly influencing property yields and vacancy rates, with factors such as NABERS ratings playing a crucial role in investment decisions

These behavioral shifts are creating both challenges and opportunities. While overall transaction volumes remain below historical averages, the bifurcation between prime and secondary assets is creating potential value opportunities for investors willing to look beyond gateway markets and trophy assets.

For Singapore specifically, the market is benefiting from its reputation as a safe haven amid uncertainty. According to RHB analysts, "Amidst a currently volatile macroeconomic backdrop, we expect Singapore-centric Reits to continue to relatively outperform and see larger fund inflows." This trend is likely to persist as long as global uncertainties remain elevated

Conclusion and Investment Implications

The relationship between U.S. Treasury yields and Asia's commercial property markets, particularly Singapore, is complex and multifaceted. While rising Treasury yields have generally created headwinds for property valuations through higher discount rates and compressed risk premiums, the impact has been uneven across markets and sectors.

Singapore's commercial property market has demonstrated remarkable resilience, supported by the country's strong macroeconomic fundamentals, proactive monetary policy, and strategic positioning as a financial safe haven. The recent moderation in domestic interest rates, coupled with the stability of the Singapore dollar, has created a relatively favorable environment for commercial real estate despite global pressures.

Looking forward, several key implications emerge for institutional investors and family offices:

1. Strategic Allocation: The current environment favors strategic rather than tactical allocation to Asian commercial real estate, with a focus on markets and sectors with strong structural growth drivers and limited supply.

2. Quality Premium: The premium for quality assets with strong tenant covenants and sustainable features is likely to persist and potentially expand, justifying more aggressive pricing for best-in-class properties.

3. Financing Strategy: With interest rates expected to remain elevated relative to historical norms, optimizing debt structures and maintaining conservative leverage ratios will be critical to investment performance.

4. Sector Selection: Residential, industrial, and select office assets in core markets like Singapore, Tokyo, and Seoul offer the most favorable risk-adjusted return profiles in the current environment.

5. Active Management: In a more challenging market environment, active asset management capabilities will be a key differentiator, with potential to drive outperformance through operational improvements and strategic repositioning

For Singapore specifically, the outlook remains cautiously positive. While growth may moderate in 2025, the combination of policy support, limited new supply in key sectors, and continued institutional demand should provide a floor for valuations. S-REITs with strong balance sheets, quality portfolios, and experienced management teams are particularly well-positioned to navigate the current environment and potentially benefit from any normalization in interest rates over the medium term.

In conclusion, while U.S. Treasury yields will continue to influence Asia's commercial property markets, including Singapore, the relationship is not deterministic. Local factors, including monetary policy, economic fundamentals, and market-specific supplydemand dynamics, play crucial roles in mediating this influence and creating opportunities for discerning investors.

Sources: MAS, Reuters, S&P Global, Business Time